Okay, let's talk about something that could be a total game-changer for Africa: a partnership between Opay and WhatsApp. 🤯

Where Are They Now?

Opay: If you live in Nigeria, chances are you've already heard of or used Opay. This platform has become a staple for handling everyday tasks. From paying utility bills and transferring funds to ordering food, Opay has seamlessly integrated into the lives of millions. With over 15 million downloads, its reach is undeniable, offering convenient solutions for both individuals and businesses alike.

WhatsApp: On the other hand, WhatsApp is the ultimate messaging giant, not just in Nigeria or Africa but globally. It boasts over 2 billion active users per month, making it the default communication app for a huge portion of the population. It's more than just texting; it's calling, video chatting, and sharing media.

What Could This Partnership Mean for Payments in Africa?

Now, imagine the synergy between these two platforms. Picture this: you're chatting with your friend on WhatsApp about that cool new restaurant you’re both excited to try. Right there, in the chat window, you send them money for your half of the bill using Opay without ever leaving WhatsApp. No switching apps. No typing in bank details or account numbers. It would be instant, seamless, and just plain convenient.

This isn't just some fancy tech dream; it could solve real-world problems. For individuals, splitting bills, paying for a service, or even gifting money becomes quick and hassle-free. For small businesses, it means immediate payments from customers without relying on physical cash or POS machines. That’s a big win, especially in an economy where cash transactions still dominate.

Plus, let’s not forget the security aspect. Integrating payments into WhatsApp would bring the added layer of encryption and privacy that WhatsApp is known for, giving people peace of mind that their transactions are safe.

How Could This Help Opay and WhatsApp Grow?

Opay: This partnership could be the rocket fuel Opay needs to scale to new heights. By integrating with WhatsApp, Opay would tap into a massive user base that already spends a lot of time on the app. This could mean a surge in new users, especially from regions where WhatsApp is already an integral part of life. With millions of potential customers just a click away, Opay’s download numbers could explode, cementing its place as the go-to payment platform across Africa.

WhatsApp: For WhatsApp, it’s a no-brainer. By adding payments directly into the app, they’re making themselves even more indispensable. It turns WhatsApp into more than just a communication tool, it becomes a one-stop shop for messaging, calling, and financial transactions. Imagine how attractive that would be for people looking for a simple, all-in-one platform. It would also keep people on the app longer, increasing engagement and, in the long run, potentially opening up more opportunities for monetization.

What Does It Mean for Africa?

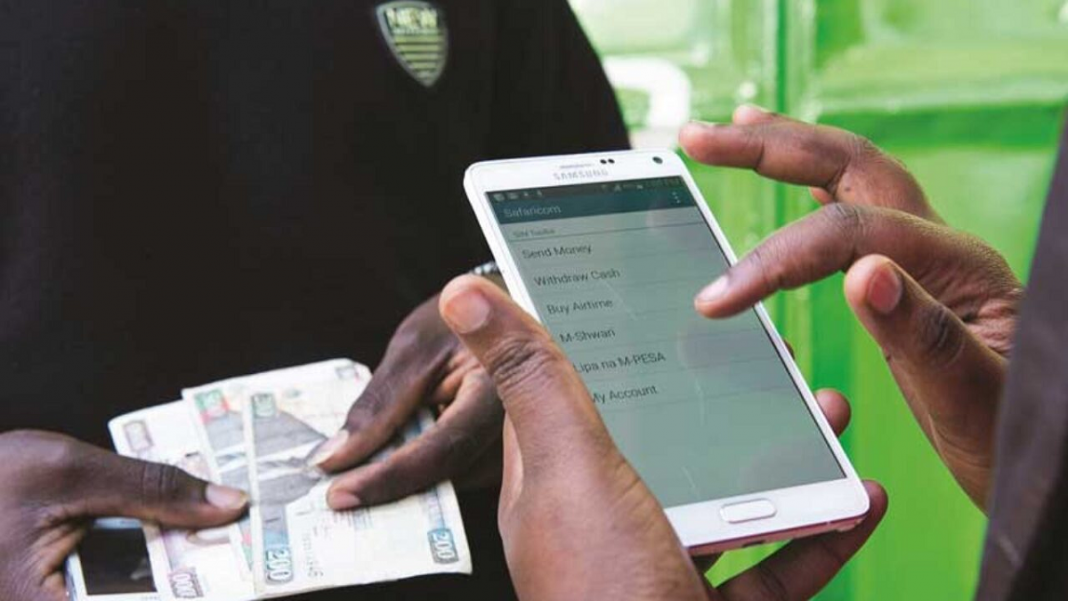

This potential partnership could be key to unlocking a whole new level of financial accessibility across the continent. In many parts of Africa, access to banking services is limited, and people often rely on informal ways to move money around. Opay integrated into WhatsApp could provide a formal, secure, and efficient alternative, reaching those who have been underserved by traditional financial institutions.

By lowering the barriers to sending and receiving money, it could foster entrepreneurship, support small businesses, and enable more people to participate in the digital economy. And in a region where mobile phone usage far outpaces traditional banking infrastructure, the timing couldn’t be better.

Fun Side Note: A Match Made in Brand Heaven 🌈

Have you ever noticed how Opay's vibrant green and WhatsApp's iconic green just click? It’s like the universe was already telling them to collaborate! With both brands rocking similar color schemes, they’re visually aligned for a perfect partnership, call it branding destiny. I mean, they say green symbolizes growth, right? So, it's no coincidence this collab would be all about growth for businesses, users, and the financial ecosystem.

Final Thoughts

This is definitely a fun thought experiment, and I find the idea of this partnership exciting. It has the potential to transform the way we handle money in Africa. Not only would it make payments easier and faster, but it would also democratize access to financial services for millions. It’s the kind of innovation that could genuinely impact lives, making financial inclusion a reality for more people across the continent.

However, while it’s an exciting idea, it’s important to acknowledge the challenges that would come with setting up such a partnership. Regulatory hurdles in various African countries, especially regarding mobile payments and data privacy, could slow down the implementation. Both Opay and WhatsApp would need to work closely with local governments and financial institutions to ensure compliance with regional banking laws. Additionally, ensuring seamless integration across various devices, networks, and payment systems could present technical difficulties that require time and resources to overcome.

Despite these challenges, it's fun to imagine the possibilities. With careful planning and execution, this partnership could revolutionize digital payments in Africa. But for now, let's keep it as an exciting "what if."

About the Author

I'm Michael Nwaokocha, a software developer from Lagos, Nigeria. I enjoy building web apps with tools like JavaScript, React, and Node.js. With a background in entrepreneurship, I like solving problems and creating things that are easy to use. In my free time, I’m usually learning or working on personal projects.

You can connect with me on LinkedIn, check out my projects on GitHub, or visit my blog.